New normal for Metro Vancouver’s housing market continues.

March 3, 2026.

Metro Vancouver home sales registered on the MLS® in February continued the recent trend of slower-than-average sales, seeing a ten per cent decline over the same period last year.

The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 1,648 in February 2026, a 9.8 per cent decrease from the 1,827 sales recorded in February 2025. This was 28.7 per cent below the 10-year seasonal average (2,310).

“With each passing data point, the pace of sales running well-below long-term averages are no longer a surprise – it’s become the new norm,” said Andrew Lis, GVR chief economist and vice-president data analytics. “A surprising finding this February, however, is that home sellers appear less eager to list their homes relative to last year with new listings down about seven percent, mostly driven by fewer listings in the apartment segment.”

There were 4,734 detached, attached and apartment properties newly listed for sale on the Multiple Listing Service® (MLS®) in Metro Vancouver in February 2026. This represents a 6.4 per cent decrease compared to the 5,057 properties listed in February 2025. This was 7.1 per cent above the 10-year seasonal average (4,421).

The total number of properties currently listed for sale on the MLS® system in Metro Vancouver is 13,545, a 6.3 per cent increase compared to February 2025 (12,744). This is 37 per cent above the 10-year seasonal average (9,886).

Across all detached, attached and apartment property types, the sales-to-active listings ratio for February 2026 is 12.6 per cent. By property type, the ratio is nine per cent for detached homes, 16.6 per cent for attached, and 14.1 per cent for apartments.

Analysis of the historical data suggests downward pressure on home prices occurs when the ratio dips below 12 per cent for a sustained period, while home prices often experience upward pressure when it surpasses 20 per cent over several months.

“With fewer sellers coming to market with their properties than last year, a pick-up in demand heading into the spring could result in a stagnation of standing inventory, which may support prices around current levels,” Lis said. “With sales slightly outpacing our 2026 forecast year-to-date, the spring market will be the litmus test of whether we continue along this new normal, or if we see any significant surprises.”

The MLS® Home Price Index composite benchmark price for all residential properties in Metro Vancouver is currently $1,100,300. This represents a 6.8 per cent decrease over February 2025 and a 0.1 per cent decrease compared to January 2026.

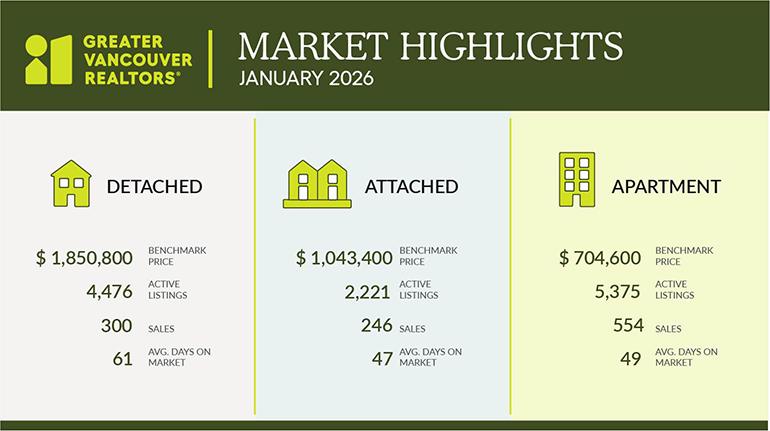

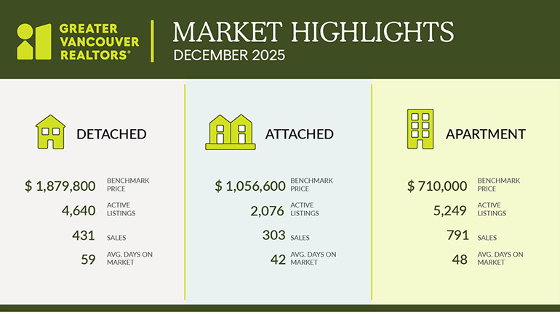

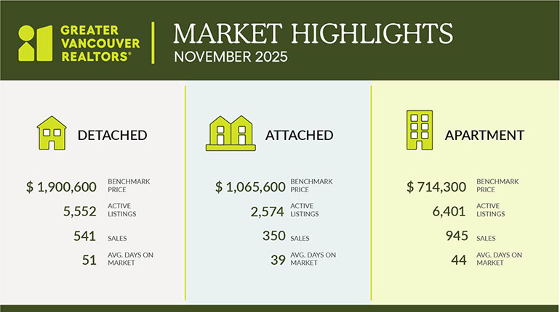

Sales of detached homes in February 2026 reached 427, a 10.5 per cent decrease from the 477 detached sales recorded in February 2025. The benchmark price for a detached home is $1,835,900. This represents an 8.8 per cent decrease from February 2025 and a 0.8 per cent decrease compared to January 2026.

Sales of apartment homes reached 824 in February 2026, a 15.6 per cent decrease compared to the 976 sales in February 2025. The benchmark price of an apartment home is $708,200. This represents a 6.8 per cent decrease from February 2025 and a 0.5 per cent increase compared to January 2026.

Attached home sales in February 2026 totalled 387, a 7.8 per cent increase compared to the 359 sales in February 2025. The benchmark price of a townhouse is $1,046,100. This represents a 5.6 per cent decrease from February 2025 and a 0.3 per cent increase compared to January 2026.