Posted on

January 3, 2024

by

Dan McCarthy

Metro Vancouver housing market shows resilience in 2023, ending the year in balanced territory.

Vancouver, B.C. - January 3, 2024.

Metro Vancouver’s housing market closed out 2023 with balanced market conditions, but the year-end totals mask a story of surprising resilience in the face of the highest borrowing costs seen in over a decade.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential sales in the region totalled 26,249 in 2023, a 10.3 per cent decrease from the 29,261 sales recorded in 2022, and a 41.5 per cent decrease from the 44,884 sales in 2021.

Last year’s sales total was 23.4 per cent below the 10-year annual sales average (34,272).

“You could miss it by just looking at the year-end totals, but 2023 was a strong year for the Metro Vancouver housing market considering that mortgage rates were the highest they’ve been in over a decade,” Andrew Lis, REBGV’s director of economics and data analytics said. “In our 2023 forecast, we called for modest price increases throughout the year while most other forecasters were predicting price declines. The fact that we ended the year with five-per-cent-plus gains in home prices across all market segments demonstrates that Metro Vancouver remains an attractive and desirable destination, and elevated borrowing costs alone aren’t enough to dissuade buyers determined to get into this market.”

Properties listed on the Multiple Listing Service® (MLS®) in Metro Vancouver totalled 50,893 in 2023. This represents a 7.5 per cent decrease compared to the 55,047 properties listed in 2022. This was 20.2 per cent below the 63,761 properties listed in 2021.

The total number of properties listed last year was 10.5 per cent below the region’s 10-year total annual average of (56,868).

Currently, the total number of homes listed for sale on the MLS® system in Metro Vancouver is 8,802, a 13 per cent increase compared to December 2022 (7,791). This is 0.3 per cent above the 10-year seasonal average (8,772).

The MLS® Home Price Index composite benchmark price for all residential properties in Metro Vancouver is currently $1,168,700. This represents a five per cent increase over December 2022 and a 1.4 per cent decrease compared to November 2023.

“Ultimately, the story of 2023 is one of too few homes available relative to the pool of willing and qualified buyers,” Lis said. “Sellers were reluctant to list their properties early in the year, which led to fewer sales than usual coming out of the gate. But this also led to near record-low inventory levels in the spring, which put upward pressure on prices as buyers competed for the scarce few homes available.”

“Looking back on the year, it’s hard not to wonder how we’d be closing out 2023 if mortgage rates had been a few per cent lower than they were. And it looks like we might get some insight into that question in 2024, as bond markets and professional forecasters are projecting lower borrowing costs are likely to come, with modest rate cuts expected in the first half of the New Year.”

December 2023 Summary.

Residential sales in the region totalled 1,345 in December 2023, a 3.2 per cent increase from the 1,303 sales recorded in December 2022. This was 36.4 per cent below the 10-year seasonal average (2,114).

There were 1,327 detached, attached and apartment properties newly listed for sale on the Multiple Listing Service® (MLS®) in Metro Vancouver in December 2023. This represents a 9.9 per cent increase compared to the 1,208 properties listed in December 2022. This was 22.7 per cent below the 10-year seasonal average (1,716).

Across all detached, attached and apartment property types, the sales-to-active listings ratio for December 2023 is 16 per cent. By property type, the ratio is 11.1 per cent for detached homes, 18.7 per cent for attached, and 19.6 per cent for apartments.

Analysis of the historical data suggests downward pressure on home prices occurs when the ratio dips below 12 per cent for a sustained period, while home prices often experience upward pressure when it surpasses 20 per cent over several months.

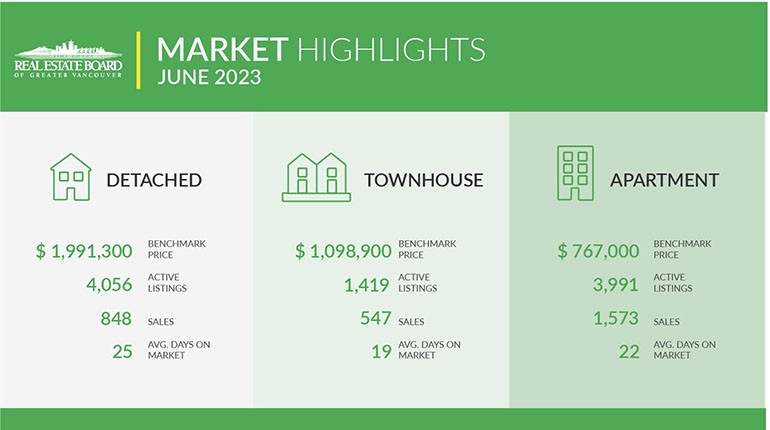

Sales of detached homes in December 2023 reached 376, a 1.3 per cent increase from the 371 detached sales recorded in December 2022. The benchmark price for a detached home is $1,964,400. This represents a 7.7 per cent increase from December 2022 and a 0.9 per cent decrease compared to November 2023.

Sales of apartment homes reached 719 in December 2023, a 2.4 per cent increase compared to the 702 sales in December 2022. The benchmark price of an apartment home is $751,300. This represents a 5.6 per cent increase from December 2022 and a 1.5 per cent decrease compared to November 2023.

Attached home sales in December 2023 totalled 238, a 7.2 per cent increase compared to the 222 sales in December 2022. The benchmark price of a townhouse is $1,072,700. This represents a 6.4 per cent increase from December 2022 and a 1.8 per cent decrease compared to November 2023.

%20-%20Copy.jpg)